Gallium Nitride Semiconductor Fabrication in 2025: Unleashing Next-Gen Power and Speed. Explore How GaN Tech is Set to Transform Electronics Manufacturing and Drive Over 20% Market Growth by 2030.

- Executive Summary: Key Trends and 2025 Market Snapshot

- Market Size, Growth Rate, and 2025–2030 Forecasts

- Technology Innovations in GaN Semiconductor Fabrication

- Major Players and Strategic Partnerships (e.g., infineon.com, navitassemi.com, gan.com)

- Manufacturing Challenges and Yield Optimization

- Applications: Power Electronics, RF, Automotive, and Beyond

- Supply Chain Dynamics and Raw Material Sourcing

- Regulatory Standards and Industry Initiatives (e.g., ieee.org, semiconductors.org)

- Regional Analysis: Asia-Pacific, North America, Europe, and Emerging Markets

- Future Outlook: Disruptive Trends and Investment Opportunities

- Sources & References

Executive Summary: Key Trends and 2025 Market Snapshot

The gallium nitride (GaN) semiconductor fabrication sector is entering 2025 with strong momentum, driven by surging demand for high-efficiency power electronics, radio frequency (RF) devices, and next-generation optoelectronics. GaN’s superior material properties—such as wide bandgap, high electron mobility, and thermal stability—are enabling rapid adoption across automotive, consumer electronics, data centers, and renewable energy applications. The global transition toward electric vehicles (EVs), 5G infrastructure, and energy-efficient power conversion is accelerating investment and innovation in GaN fabrication technologies.

Key industry players are scaling up production capacity and refining manufacturing processes to meet this demand. Infineon Technologies AG has expanded its GaN-on-silicon production lines, targeting automotive and industrial power modules. STMicroelectronics is ramping up its GaN device output, leveraging its European fabs to supply power and RF markets. NXP Semiconductors continues to advance GaN RF solutions for 5G base stations and radar systems, while Wolfspeed, Inc. is investing in large-scale GaN wafer production, complementing its established silicon carbide (SiC) business.

In 2025, the industry is witnessing a shift toward 200mm GaN-on-silicon wafer processing, which promises improved economies of scale and compatibility with existing CMOS fabs. This transition is being spearheaded by companies such as imec, a leading R&D hub, and Renesas Electronics Corporation, which are both collaborating with foundries to accelerate 200mm GaN adoption. Meanwhile, onsemi and ROHM Semiconductor are focusing on vertical integration, from epitaxial wafer growth to device packaging, to ensure quality and supply chain resilience.

Strategic partnerships and joint ventures are shaping the competitive landscape. For example, Panasonic Corporation and Infineon Technologies AG have deepened their collaboration on GaN power devices, while Samsung Electronics is exploring GaN integration for advanced mobile and consumer applications. The sector is also seeing increased activity from foundries such as Taiwan Semiconductor Manufacturing Company (TSMC), which is offering GaN process technologies to fabless customers.

Looking ahead, the GaN semiconductor fabrication market in 2025 is characterized by rapid capacity expansion, process innovation, and ecosystem collaboration. With major players investing in 200mm wafer technology, vertical integration, and new application segments, the outlook for the next few years points to robust growth, greater supply chain maturity, and broader adoption of GaN devices across multiple industries.

Market Size, Growth Rate, and 2025–2030 Forecasts

The global market for gallium nitride (GaN) semiconductor fabrication is experiencing robust growth, driven by expanding applications in power electronics, radio frequency (RF) devices, and optoelectronics. As of 2025, the sector is characterized by significant investments in manufacturing capacity, technological advancements, and increasing adoption across automotive, consumer electronics, and industrial sectors.

Key industry players such as Infineon Technologies AG, STMicroelectronics, NXP Semiconductors, and Wolfspeed, Inc. are expanding their GaN fabrication capabilities to meet surging demand. For instance, Wolfspeed, Inc. has recently ramped up production at its Mohawk Valley Fab, the world’s largest 200mm silicon carbide and GaN device fabrication facility, aiming to address the growing needs of electric vehicles and renewable energy sectors. Similarly, Infineon Technologies AG is investing in new GaN production lines to support its power electronics portfolio, targeting applications in fast chargers, data centers, and solar inverters.

The market size for GaN semiconductor devices is projected to surpass several billion USD by 2025, with compound annual growth rates (CAGR) estimated in the double digits through 2030. This growth is underpinned by the superior performance characteristics of GaN—such as higher breakdown voltage, faster switching speeds, and greater energy efficiency—compared to traditional silicon-based semiconductors. STMicroelectronics and NXP Semiconductors are both scaling up their GaN device portfolios, with a focus on automotive and industrial power conversion, as well as 5G infrastructure.

Looking ahead to 2030, the GaN fabrication market is expected to benefit from continued electrification trends, especially in electric vehicles, renewable energy systems, and high-frequency communications. The expansion of 5G networks and the proliferation of fast-charging consumer devices are anticipated to further accelerate demand. Industry consortia and standards bodies, such as the Semiconductor Industry Association, are also supporting research and collaboration to address supply chain challenges and promote innovation in GaN manufacturing processes.

In summary, the period from 2025 to 2030 is set to witness sustained growth in GaN semiconductor fabrication, with leading manufacturers investing in capacity expansion and technology development to capture emerging opportunities across multiple high-growth sectors.

Technology Innovations in GaN Semiconductor Fabrication

The landscape of gallium nitride (GaN) semiconductor fabrication is undergoing rapid transformation in 2025, driven by escalating demand for high-efficiency power electronics, radio frequency (RF) devices, and next-generation optoelectronics. GaN’s wide bandgap, high electron mobility, and superior thermal conductivity have positioned it as a critical material for applications ranging from electric vehicles to 5G infrastructure and data centers.

A key innovation in 2025 is the maturation of GaN-on-silicon (GaN-on-Si) and GaN-on-silicon carbide (GaN-on-SiC) epitaxial growth techniques. These approaches enable larger wafer sizes and improved yield, addressing cost and scalability challenges. Infineon Technologies AG has expanded its 200mm GaN-on-Si production lines, aiming to meet the surging demand for efficient power conversion in automotive and industrial sectors. Similarly, Wolfspeed, Inc. continues to advance GaN-on-SiC technology, leveraging its expertise in wide bandgap materials to deliver high-performance RF and power devices.

Device architecture is also evolving. The industry is witnessing the commercialization of vertical GaN transistors, which promise higher breakdown voltages and current densities compared to traditional lateral devices. NXP Semiconductors N.V. and STMicroelectronics are actively developing vertical GaN solutions, targeting applications in fast-charging, renewable energy, and electric mobility. These innovations are expected to push GaN devices into voltage classes above 650V, broadening their applicability.

Another significant trend is the integration of GaN devices with advanced packaging technologies. Companies like ROHM Co., Ltd. and Renesas Electronics Corporation are introducing chip-scale and surface-mount GaN power devices, which reduce parasitic losses and enable compact, high-efficiency modules. This is particularly relevant for data center power supplies and telecom infrastructure, where space and energy efficiency are paramount.

Looking ahead, the GaN fabrication ecosystem is expected to benefit from increased collaboration between material suppliers, foundries, and system integrators. Strategic investments in wafer capacity and process automation are underway, with onsemi and pSemi Corporation (a Murata company) expanding their GaN portfolios and manufacturing capabilities. As process maturity improves and costs decline, GaN is poised to capture a larger share of the power and RF semiconductor markets through 2025 and beyond.

Major Players and Strategic Partnerships (e.g., infineon.com, navitassemi.com, gan.com)

The landscape of Gallium Nitride (GaN) semiconductor fabrication in 2025 is defined by a dynamic interplay among established industry leaders, innovative startups, and a growing web of strategic partnerships. As demand for high-efficiency power electronics and RF devices accelerates, major players are scaling up production, investing in new facilities, and forging alliances to secure supply chains and accelerate technology adoption.

Among the most prominent companies, Infineon Technologies AG stands out for its vertically integrated approach, encompassing GaN device design, epitaxy, and packaging. In recent years, Infineon has expanded its GaN-on-silicon manufacturing capacity and deepened collaborations with foundry partners to address surging demand in automotive, industrial, and consumer applications. The company’s focus on reliability and automotive qualification has positioned it as a preferred supplier for next-generation electric vehicles and renewable energy systems.

Another key player, Navitas Semiconductor, has pioneered GaN power ICs, integrating GaN transistors and drive circuitry on a single chip. Navitas’ “GaNFast” platform is widely adopted in fast chargers and data center power supplies. The company has entered into multiple strategic partnerships with contract manufacturers and system integrators to accelerate global deployment, and in 2024-2025, it is expanding its ecosystem through collaborations with leading OEMs in consumer electronics and computing.

Transphorm Inc. is another significant contributor, focusing on high-voltage GaN solutions for industrial and automotive markets. Transphorm operates its own wafer fabrication facilities and has established joint ventures with Asian foundries to ensure scalable, cost-effective production. The company’s close ties with automotive suppliers and power module manufacturers are expected to drive further adoption of GaN in electric mobility and grid infrastructure.

Strategic partnerships are a hallmark of the current GaN fabrication sector. For example, Infineon and Transphorm Inc. have both entered into technology licensing and co-development agreements with global foundries and substrate suppliers to secure access to advanced GaN-on-silicon and GaN-on-SiC processes. Meanwhile, Navitas Semiconductor has announced collaborations with packaging specialists to develop high-density, thermally efficient modules for AI servers and 5G base stations.

Looking ahead, the next few years will likely see further consolidation and cross-border alliances as companies seek to overcome supply chain constraints and accelerate time-to-market. The entry of new players from Asia and Europe, combined with ongoing investments by established leaders, is expected to drive innovation and expand the addressable market for GaN semiconductors across automotive, industrial, and consumer sectors.

Manufacturing Challenges and Yield Optimization

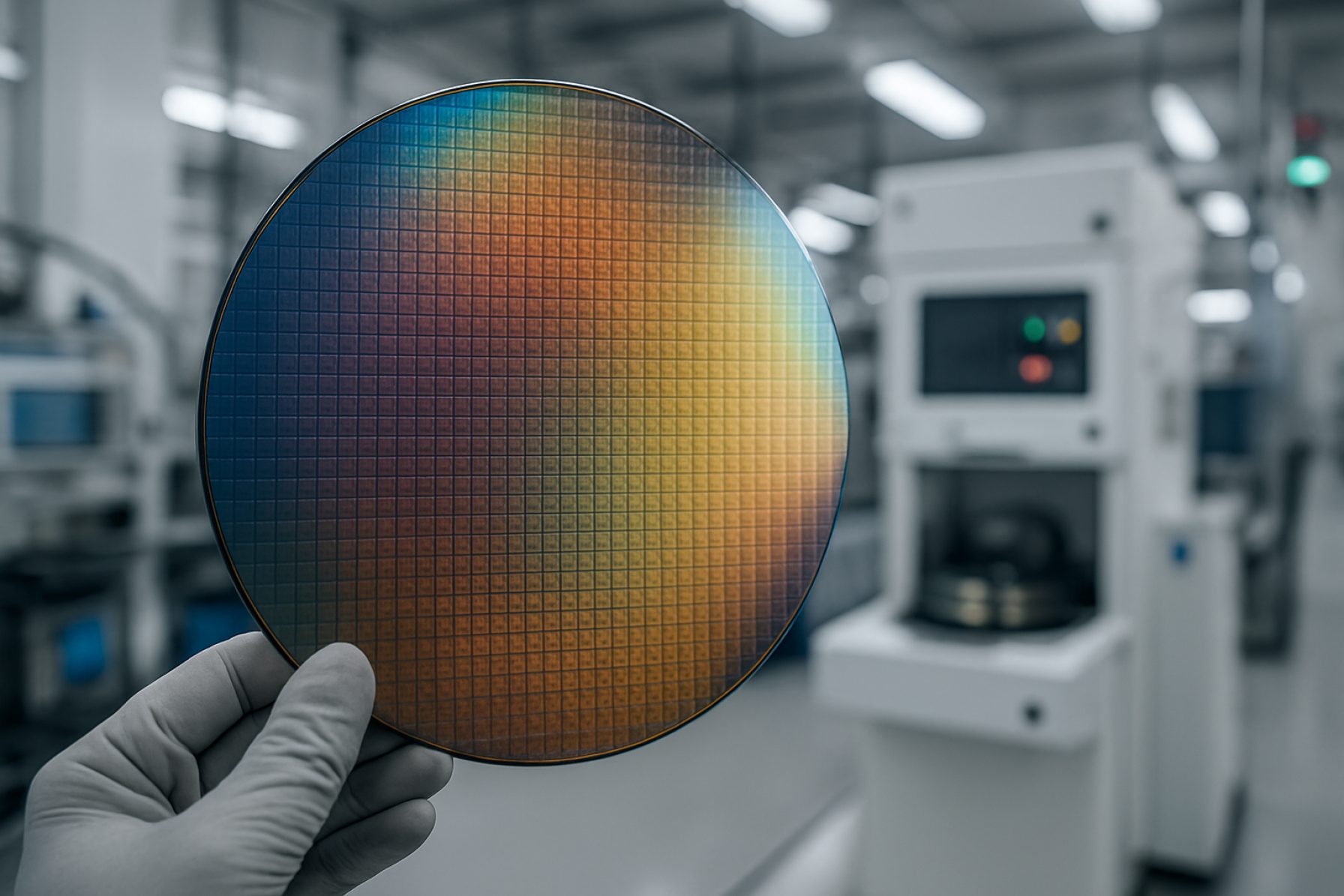

Gallium Nitride (GaN) semiconductor fabrication has advanced rapidly, but manufacturing challenges and yield optimization remain central concerns as the industry scales in 2025 and beyond. GaN’s unique material properties—such as wide bandgap, high electron mobility, and thermal stability—enable superior device performance compared to silicon, but also introduce complexities in wafer production, device processing, and defect management.

A primary challenge is the availability and quality of GaN substrates. While silicon-based GaN epitaxy (GaN-on-Si) is cost-effective and leverages existing silicon foundry infrastructure, it suffers from lattice and thermal mismatch, leading to high defect densities and wafer bowing. Native GaN substrates, though offering lower defect densities and better performance, remain expensive and limited in size. Leading manufacturers such as Nichia Corporation and Ammono (now part of onsemi) have made progress in producing high-quality bulk GaN crystals, but scaling to 6-inch and 8-inch wafers with acceptable yields is still a work in progress.

Epitaxial growth techniques, particularly Metal-Organic Chemical Vapor Deposition (MOCVD), are critical for device quality. Companies like AZ Electronic Materials and Kyocera Corporation supply advanced MOCVD equipment and process materials, focusing on uniformity and defect reduction. However, controlling dislocation densities and achieving consistent layer thickness across large wafers remain significant hurdles. In 2025, process innovations such as in-situ monitoring and advanced precursor chemistries are being adopted to improve yield and reproducibility.

Device fabrication also faces challenges in etching, metallization, and passivation. GaN’s chemical inertness complicates plasma etching and cleaning steps, while achieving low-resistance ohmic contacts without damaging the underlying material is an ongoing area of research. Infineon Technologies AG and STMicroelectronics are investing in proprietary process flows and toolsets to address these issues, aiming to boost device reliability and production throughput.

Yield optimization is increasingly driven by advanced inspection and metrology. Automated defect inspection systems, supplied by companies like KLA Corporation, are being integrated into GaN fabs to detect sub-micron defects and enable real-time process adjustments. Data analytics and AI-driven process control are expected to further enhance yields over the next few years, as fabs move toward higher-volume production for automotive, 5G, and power electronics markets.

Looking ahead, the GaN semiconductor industry is expected to see incremental improvements in substrate quality, process control, and yield management. As leading players continue to invest in R&D and scale up production, the cost gap with silicon is projected to narrow, accelerating GaN’s adoption in mainstream applications.

Applications: Power Electronics, RF, Automotive, and Beyond

Gallium Nitride (GaN) semiconductor fabrication is rapidly transforming multiple high-impact sectors, with 2025 marking a pivotal year for its adoption in power electronics, radio frequency (RF) applications, automotive systems, and emerging fields. The unique material properties of GaN—such as wide bandgap, high electron mobility, and superior thermal conductivity—enable devices that outperform traditional silicon-based components in efficiency, size, and power handling.

In power electronics, GaN devices are increasingly favored for applications ranging from consumer fast chargers to industrial power supplies. Leading manufacturers like Infineon Technologies AG and onsemi have expanded their GaN product portfolios, focusing on high-volume, high-efficiency solutions for data centers, renewable energy inverters, and electric vehicle (EV) charging infrastructure. Infineon Technologies AG has announced significant investments in GaN fabrication capacity, targeting both discrete and integrated power solutions for 2025 and beyond. Similarly, onsemi is scaling up its GaN manufacturing to meet surging demand in automotive and industrial markets.

RF applications, particularly in 5G telecommunications and satellite communications, are another major growth area. GaN’s high-frequency performance and power density make it ideal for RF amplifiers and transceivers. Nexperia and MACOM Technology Solutions are actively developing GaN-on-Si and GaN-on-SiC RF devices, with new fabrication lines coming online to support the rollout of advanced wireless infrastructure. These companies are collaborating with network equipment providers to integrate GaN technology into next-generation base stations and phased array antennas.

The automotive sector is witnessing accelerated GaN adoption, especially in EV powertrains, onboard chargers, and advanced driver-assistance systems (ADAS). STMicroelectronics and ROHM Semiconductor are investing in dedicated GaN fabrication facilities and partnerships with automotive OEMs to deliver qualified, automotive-grade GaN devices. These efforts are expected to yield higher efficiency and reduced system weight, directly supporting the electrification and digitalization trends in the automotive industry.

Beyond these established domains, GaN fabrication is enabling innovation in areas such as LiDAR, wireless power transfer, and quantum computing. Companies like Navitas Semiconductor are pioneering GaN integration for compact, high-frequency power modules, while research collaborations are exploring GaN’s potential in photonics and high-voltage switching.

Looking ahead, the outlook for GaN semiconductor fabrication is robust. Industry leaders are scaling up 200mm wafer production, automating fabrication processes, and investing in supply chain resilience to meet projected double-digit annual growth rates through the late 2020s. As device performance and reliability continue to improve, GaN is poised to become a foundational technology across power, RF, automotive, and emerging application spaces.

Supply Chain Dynamics and Raw Material Sourcing

The supply chain dynamics and raw material sourcing for gallium nitride (GaN) semiconductor fabrication are undergoing significant transformation as the industry scales to meet surging demand in power electronics, RF devices, and electric vehicles. In 2025, the global GaN market is characterized by both opportunities and challenges, particularly in securing high-purity gallium and nitrogen sources, as well as in the development of advanced substrate technologies.

Gallium, a critical raw material for GaN, is primarily obtained as a byproduct of bauxite (aluminum ore) and zinc processing. The majority of global gallium production is concentrated in China, which accounts for over 90% of refined gallium output. This concentration raises concerns about supply security and price volatility, especially as geopolitical tensions and export controls can impact availability. Major semiconductor manufacturers such as Infineon Technologies AG and STMicroelectronics are actively working to diversify their supply chains and establish strategic partnerships with gallium producers to mitigate these risks.

Nitrogen, the other essential element in GaN, is widely available and typically sourced from air separation units. However, the purity requirements for semiconductor-grade nitrogen are stringent, necessitating advanced purification processes. Companies like Air Liquide play a pivotal role in supplying ultra-high purity gases to GaN fabrication facilities worldwide.

Substrate technology is another critical aspect of the GaN supply chain. While GaN-on-silicon (GaN-on-Si) and GaN-on-silicon carbide (GaN-on-SiC) are the dominant platforms, the availability and cost of high-quality substrates remain a bottleneck. onsemi and Wolfspeed, Inc. are among the leading suppliers of SiC substrates, investing heavily in expanding their manufacturing capacities to support the growing GaN device market. Meanwhile, ams OSRAM and Nichia Corporation are notable for their vertical integration, controlling both substrate and epitaxial wafer production for optoelectronic and power applications.

Looking ahead, the GaN semiconductor supply chain is expected to become more resilient as manufacturers pursue regional diversification, recycling initiatives, and alternative sourcing strategies. Efforts to develop gallium recycling from end-of-life electronics and to establish new refining capacities outside China are gaining momentum. Additionally, industry collaborations and government support in the US, Europe, and Japan aim to secure critical material supply and foster innovation in GaN fabrication technologies. These trends are likely to shape the competitive landscape and ensure a more stable supply of raw materials for GaN semiconductors in the coming years.

Regulatory Standards and Industry Initiatives (e.g., ieee.org, semiconductors.org)

The regulatory landscape and industry initiatives surrounding Gallium Nitride (GaN) semiconductor fabrication are evolving rapidly as the technology matures and adoption accelerates in power electronics, RF, and automotive sectors. In 2025, the focus is on harmonizing standards, ensuring device reliability, and fostering sustainable manufacturing practices.

Key industry bodies such as the IEEE and the Semiconductor Industry Association (SIA) are at the forefront of developing and updating technical standards for GaN devices. The IEEE, through its Power Electronics Society and Standards Association, is actively working on specifications for GaN device characterization, reliability testing, and system integration, aiming to provide a common framework for manufacturers and end-users. These standards are critical for ensuring interoperability and safety, particularly as GaN devices are increasingly deployed in high-voltage and high-frequency applications.

The SIA, representing leading semiconductor manufacturers, is advocating for policies that support domestic GaN fabrication capabilities, supply chain resilience, and R&D investment. In 2025, the SIA is collaborating with government agencies to address export controls, environmental regulations, and workforce development tailored to the unique requirements of wide bandgap semiconductors like GaN. This includes input into the implementation of the CHIPS and Science Act in the United States, which allocates funding for advanced semiconductor manufacturing and research infrastructure.

On the manufacturing side, major GaN device producers such as Infineon Technologies AG, NXP Semiconductors, and STMicroelectronics are participating in industry consortia and public-private partnerships to establish best practices for wafer processing, epitaxial growth, and device packaging. These initiatives often focus on improving yield, reducing defect densities, and standardizing reliability metrics, which are essential for scaling up production and meeting the stringent requirements of automotive and industrial customers.

Environmental and safety standards are also gaining prominence. Organizations such as the SIA and the IEEE are working with regulatory agencies to develop guidelines for the safe handling of GaN materials, waste management, and energy-efficient manufacturing processes. These efforts are expected to intensify over the next few years as regulatory scrutiny increases and sustainability becomes a key differentiator in the semiconductor industry.

Looking ahead, the convergence of regulatory standards and proactive industry initiatives is expected to accelerate the adoption of GaN technology, enhance global competitiveness, and ensure that fabrication processes meet the highest benchmarks for quality, safety, and environmental stewardship.

Regional Analysis: Asia-Pacific, North America, Europe, and Emerging Markets

The global landscape for gallium nitride (GaN) semiconductor fabrication is rapidly evolving, with significant regional dynamics shaping the industry’s trajectory through 2025 and beyond. The Asia-Pacific region, North America, Europe, and select emerging markets are all playing distinct roles in the expansion and innovation of GaN technology, driven by demand in power electronics, RF devices, and electric vehicles.

Asia-Pacific remains the epicenter of GaN semiconductor manufacturing, led by countries such as Taiwan, Japan, South Korea, and China. Taiwan’s Taiwan Semiconductor Manufacturing Company (TSMC) is scaling up GaN-on-Si processes, targeting high-volume applications in power management and automotive sectors. Japan’s ROHM Semiconductor and Panasonic Corporation are advancing GaN device integration for consumer and industrial markets, leveraging their established expertise in materials and device engineering. China is investing heavily in domestic GaN capacity, with companies like Sanan Optoelectronics expanding wafer production and device fabrication to reduce reliance on imports and support the country’s electrification and 5G infrastructure goals.

North America is characterized by a strong focus on innovation and vertical integration. Wolfspeed (formerly Cree) is a leading U.S. player, operating the world’s largest 200mm GaN-on-SiC fabrication facility and supplying devices for automotive, renewable energy, and defense applications. Navitas Semiconductor is pioneering GaN power ICs, with manufacturing partnerships in Asia but R&D and design centered in the U.S. The region benefits from robust government and defense sector support, accelerating the adoption of GaN in high-frequency and high-power applications.

Europe is consolidating its position through collaborative R&D and strategic investments. Infineon Technologies in Germany is ramping up GaN device production for industrial and automotive markets, while France’s STMicroelectronics is expanding its GaN-on-Si product lines and partnering with foundries for scalable manufacturing. The European Union’s focus on semiconductor sovereignty and green energy transition is expected to drive further investment in GaN fabrication capacity and supply chain resilience.

Emerging markets in Southeast Asia and India are beginning to establish a presence in GaN fabrication, primarily through government-backed initiatives and partnerships with established global players. These regions are targeting niche applications and local demand, with the potential to become important contributors to the global supply chain as technology transfer and investment accelerate over the next few years.

Looking ahead, regional competition and collaboration will continue to shape the GaN semiconductor fabrication landscape, with Asia-Pacific maintaining manufacturing leadership, North America and Europe driving innovation and strategic autonomy, and emerging markets gradually increasing their participation in the global value chain.

Future Outlook: Disruptive Trends and Investment Opportunities

The future of gallium nitride (GaN) semiconductor fabrication is poised for significant transformation in 2025 and the following years, driven by disruptive trends and robust investment activity. GaN’s superior material properties—such as high electron mobility, wide bandgap, and thermal stability—are catalyzing its adoption in power electronics, radio frequency (RF) devices, and next-generation optoelectronics. As silicon approaches its physical and performance limits, GaN is increasingly viewed as a strategic enabler for high-efficiency, compact, and high-frequency applications.

A key trend is the rapid scaling of GaN-on-silicon (GaN-on-Si) technology, which enables cost-effective, large-diameter wafer processing using existing silicon foundry infrastructure. Major players such as Infineon Technologies AG and STMicroelectronics have announced substantial investments in expanding their GaN production capacities, with new dedicated lines and partnerships aimed at automotive, industrial, and consumer markets. Infineon Technologies AG is ramping up its Villach, Austria facility for GaN power devices, while STMicroelectronics is collaborating with foundry partners to accelerate GaN device commercialization.

Another disruptive trend is the integration of GaN devices into advanced packaging and heterogeneous integration platforms. Companies like NXP Semiconductors and Navitas Semiconductor are pioneering GaN-based power ICs and modules, targeting fast-charging, data center, and renewable energy applications. The move toward monolithic integration of GaN transistors and drivers is expected to further reduce system size and cost, while improving efficiency and reliability.

On the RF front, Qorvo, Inc. and Wolfspeed, Inc. (formerly Cree) are expanding their GaN-on-SiC (silicon carbide) and GaN-on-Si portfolios for 5G infrastructure, satellite communications, and defense systems. These companies are investing in new fabrication lines and process innovations to meet the surging demand for high-power, high-frequency RF components.

Looking ahead, the GaN fabrication ecosystem is attracting significant venture capital and strategic investment, particularly in Europe, the US, and Asia. Government initiatives supporting wide bandgap semiconductor manufacturing—such as the European Chips Act and US CHIPS Act—are expected to further accelerate GaN technology development and localization. As a result, the next few years will likely see intensified competition, rapid technology maturation, and new entrants, especially as electric vehicles, renewables, and AI-driven data centers drive demand for high-performance power and RF solutions.

Sources & References

- Infineon Technologies AG

- STMicroelectronics

- NXP Semiconductors

- Wolfspeed, Inc.

- imec

- ROHM Semiconductor

- Semiconductor Industry Association

- pSemi Corporation

- Infineon Technologies AG

- Navitas Semiconductor

- Transphorm Inc.

- Nichia Corporation

- KLA Corporation

- Nexperia

- STMicroelectronics

- Air Liquide

- ams OSRAM

- IEEE

- Sanan Optoelectronics

- Wolfspeed, Inc.